Speedrunning MSTR 2.0 Clones. Now With Extra Hype

Updating the arms race to out-MicroStrategy MicroStrategy

speedrunning (noun)

/ˈspiːdˌrʌnɪŋ/

The act of completing a video game or a segment of one as fast as possible, often using optimized routes, game mechanics, or just straight-up exploits.

Example:

They found the infinite money glitch and started speedrunning MicroStrategy: Selling $1 of Bitcoin for $2 worth of equity. Fast.

What a difference a week makes.

Since I wrote on the Great Bitcoin Copy Machine, a whole cottage industry is running the MSTR 2.0 playbook faster, and with more extremes, than the TradFi and White House insiders can manage.

One class of investors not benefiting? Microstrategy’s. As BTC hits all-time highs, MSTR has… not. Blame all the shiny new things.

“Volatility is Vitality”

Forget fundamentals. Volatility is the product. These “Treasury companies” just slap on a Bitcoin wrapper, add some hope, and sell that hope. At a massive premium.

And right now? Volatility is selling.

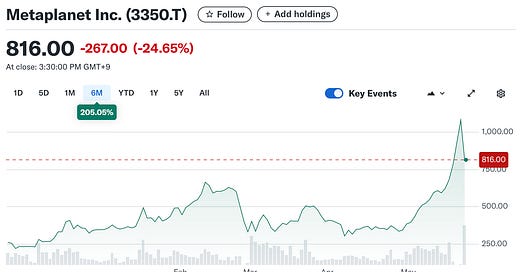

Exhibit A? Metaplanet. Another would-be Bitcoin Treasury Company trading as high as 6x Bitcoin NAV at the top.

It’s cooled a bit. Now it’s a much more reasonable 4x.

Naturally, it’s already spawning imitators. Moon Inc. now promises to “deploy the Metaplanet playbook” (translation: buy Bitcoin and issue stock into the hype).

With GameStop announcing its Bitcoin treasury purchases, we’re even getting the ultimate crossover event:

Bitcoin × Memestocks.

(A Bitcoin Treasury Company you can buy on Robinhood)

Brokers from all over the world want a piece of the action too:

Where will it end?

Call me a Boomer (I’m actually an Xer) but I just don’t see any value in owning Bitcoin at 6x to 10x the price of Bitcoin.

But hey, who am I to fight the WallStreetBets crowd of crypto?