Don’t Blame the Bond Vigilantes

If you listen closely, what’s spooking markets these days isn’t deficits. It’s something else.

It’s just like a nursury rhyme from my childhood.

The goblins were made-up. But the fear was real.

Perhaps the same goes for the so-called bond vigilantes.

You’ve heard the story: If politicians get too loose with the purse strings, these invisible debt enforcers rise up from the spreadsheets and punish them. Dumping bonds and spiking yields.

The cost of borrowing anything…mortgages, credit cards, car loans…goes up. As the US Treasury bond market is where most borrowing costs are decided.

According to the financial press, the vigilantes are real, and they’re back. With a vengeance. And thank God, apparently.

But to me the bond vigilante story doesn’t ring true. Riley had goblins. The Russians have Baba Yaga. Investors have Ed Yardeni.

“F*cking Bond Traders”

Treasury bond investors have long been cast as the market’s moral enforcers. In 1993, “they” threatened to go on a buyer’s strike.

You mean to tell me that the success of my program and my re-election hinges on the Federal Reserve and a bunch of f*cking bond traders?

- Bill Clinton (In The Agenda, Bob Woodward).

Apparently, yes. Clinton was forced to prioritize debt reduction over new public spending. This was, to many, evidence of the power of the bond bogeymen:

I used to think if there was reincarnation, I wanted to come back as the president or the pope or a .400 baseball hitter. But now I want to come back as the bond market. You can intimidate everybody.

- James Carville, Clinton’s lead strategist (WSJ Feb 25, 1993).

The term “bond vigilantes” was first coined by economist Ed Yardeni in 1983. The mere existence of these select market participants force constraints on government fiscal and monetary policies.

If the money flows too freely, the newly alert vigilantes will show up to spoil the fun, selling off the nation’s bonds and currency.

- FT.com

It was a perfect analogy: a moral framework for market moves.

God Bless the Bond Vigilantes?

Like all truly scary monsters, the bond vigilantes don’t need to show up in person. Their reputation does the work.

But perhaps it’s just a convenient narrative device. And they are phantoms conjured to spook policymakers out of doing something populist.

The business media sure believes they are real, if also mysterious.

They also let everyone off the hook.

When markets wobble, it’s the vigilantes. When politicians suddenly rediscover fiscal restraint, it’s the vigilantes. The monster is always just offscreen, but threatens to appear like a mafia don:

That’s a nice government budget you’ve got there... shame if yields were to spike.

Just ask Liz Truss. The UK prime minister’s economic plan tried to leap over bondholder common sense—and landed in the shredder.

Nice pension system you’ve got there… shame if it collapsed over a Friday lunch.

So yes, the vigilantes might be back. Or maybe it’s just what happens when leverage meets policy delusion in a room with no exit signs.

Are They Really Back?

Since Trump’s Liberation Day, long yields have spiked and the US dollar has taken a nap. Cue the headlines: The vigilantes are back.

Markets wobble, commentators reach for the old script, and someone calls Ed Yardeni.

But let’s slow down. Are we really watching fiscal justice in action? Or is it something else?

Here’s what the Financial Times asked recently:

Do you really exist? Are you really a shadowy cabal of global investors that punishes governments for bad ideas? Well, that’s unclear.

Translation: Maybe, maybe not, but it’s a hell of a headline.

Even Donald Trump, hardly known for nuance, sensed something big was up:

I was watching the bond market. That bond market is very tricky.

Meanwhile, Yardeni—the original vigilante myth-maker—told CNN:

Bond vigilantes were screaming that they weren’t happy with what was going on.

But were they? Or is that just what it sounds like when a few highly-leveraged funds realize they’ve built a mansion on a sand dune of low volatility?

Because if you listen closely, what’s spooking markets these days isn’t deficits. It’s dumb policy.

The vigilantes may be riding again. I doubt it. Maybe it’s just the algos having a panic attack.

What if the Bogeyman Doesn’t Exist?

Here’s the thing no one likes to admit: most Treasury buyers aren’t out there making moral judgments. They’re just... stuck.

Mutual funds? Chained to benchmarks. Money market funds? Need somewhere safe to sleep at night. Central banks? They have to hold dollars, though they can control duration.

They’re not making statements. They’re just following mandates.

Long bond yields have been higher than this. The 10-year was more so at the same point this year: 20 basis points higher than yesterday. And T-bill yields have barely flinched.

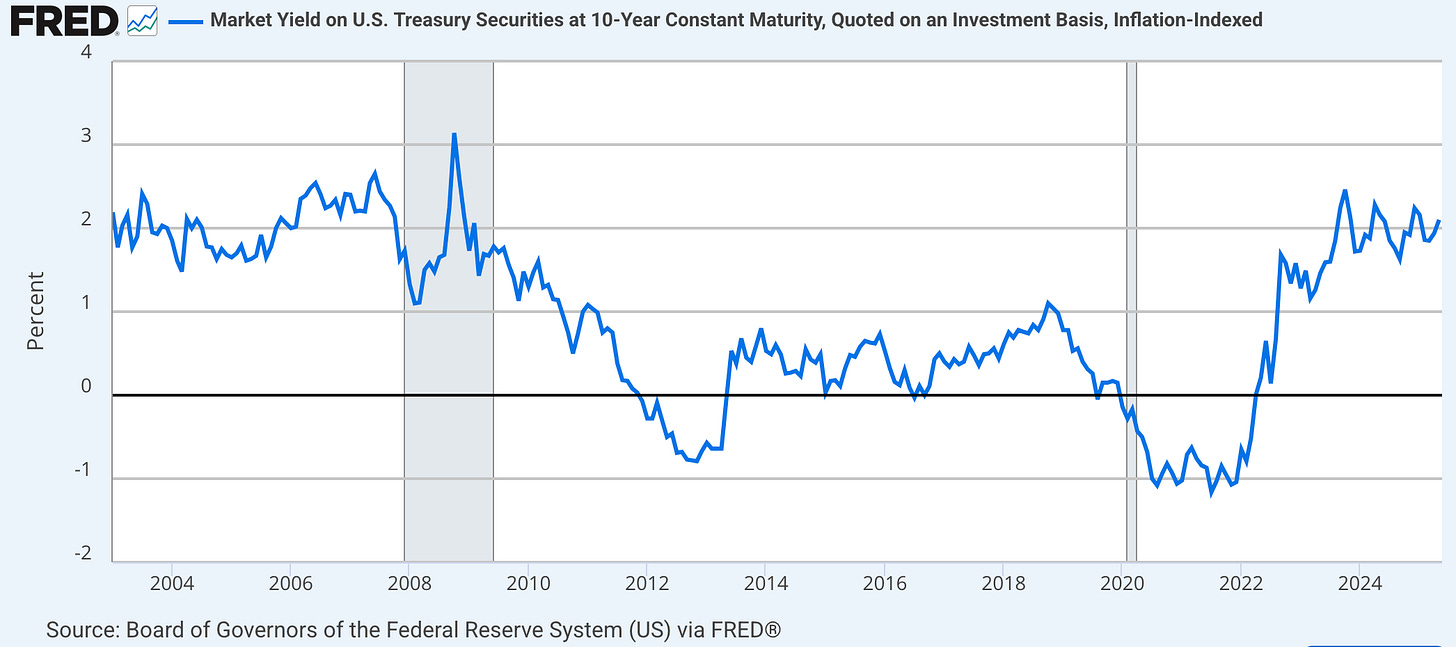

If the vigilantes were really back, they didn’t bring much firepower. You call this volatility? The 10yr inflation-indexed rate is around where it was earlier this century:

JGB rates, along with many others, are rising in sympathy. Can the bond vigilantes be in more than one place? Even if they’ve left the US, they havent gone to Japan. Or to Europe. So are they attacking all markets?

You know when they also didn’t show up? After the Global Financial Crisis. Government blew the fiscal doors off. The vigilantes? Nowhere.

COVID? Same story. Trillions of spending, zero vigilante drama. Even when S&P downgraded the US yields... went down.

That’s not a market rebellion. That’s a nap.

So maybe the bogeyman doesn’t exist. Maybe he never did.

So why now?

That’s a good question that probably deserves a book, but here’s the short version.

The problem isn’t debt. It’s disappointment.

While actual volatility may not be back, uncertainty has certainly increased.

The past 30 years trained bond investors to expect two things: falling rates and Federal Reserve protection. Rates went down, volatility stayed tame, and if anything ever spooked the market, Greenspan (and later Bernanke, Yellen, Powell) would show up with a monetary firehose. The Dealer of Last Resort.

You could lever up. You could ride the curve. You could win.

But when you leverage big, you better be good at risk management. Occasionally you are going to take a hit. Any hint of that hint, and it’s best to fold. It’s not often you get a bell ringing to signal a problem. We got it this time.

Fiscal Morality Is Out. Risk Management Is In.

Forget the 1993 Clinton drama. The real cautionary tale came in 1994.

Fiscal austerity was in. No need for vigilantes. But then the Fed hiked rates faster than expected. The result? What the bond market affectionately calls "The Great Bond Massacre." More than $1.5 trillion erased from portfolios.

Why? Because everyone was long, complacent, and overconfident.

From 13.84% in 1984 to 6% in early ’94, long-term rates had been falling like clockwork. Even Black Monday in 1987 didn’t derail the trend. Alan Greenspan and the Fed blinked then, and the market never forgot it.

So the trades kept coming. The leverage kept growing.

In 1994 Stanley Druckenmiller’s fund lost $650 million. Orange County imploded. Pension funds cried. And the Fed? It eventually stepped back in—delivering the second installment of the now-famous Greenspan Put.

And so it began: two decades of mostly falling rates, rising leverage, and carry trades that worked—until they didn’t.

Because the buyers of Treasuries had changed.

No longer just pension funds or central banks. Now it was hedge funds. Basis traders. Banks running internal VaR models.

These aren’t fiscal hawks. They’re volatility chickens.

Volatility is their kryptonite. Leveraged 10x, 20x, even 50x, a small move can blow up your quarter—or your fund.

They don’t care if the deficit is 5% or 15%. But if yields start shaking, they start selling.

They’re not vigilantes. They’re opportunists. And right now, the opportunity is in not getting wrecked.

And that’s who policymakers should be really afraid of. The Fed knows, and bails them out occasionally, but it can’t undo politically-induced volatility.

Markets Aren’t Spooked by Spending—They’re Spooked by Stupid

Let’s be honest: coming into April 2025, investors and traders weren’t "complacent." They were sedated.

Sure, a few unlucky banks—RIP SVB—got pancaked when rates went vertical in 2023. But the big dogs? The systemically important, heavily leveraged institutions? They mostly shrugged. They’ve got the balance sheet to bury mark-to-market pain in the footnotes.

And the hedge funds? They did OK. They were long duration, but hedged to the teeth. The basis trade held. As confirmed by insiders here.

But they became wary. Very wary. What scares them is political chaos masquerading as policy. Flip-flopping on tariffs. Debt ceiling hostage situations. When you’re levered 10 to 50 times and the story turns from boring to weird, you don’t protest. You hit the exit. Fast.

The MOVE index, measuring the cost of options on bonds, is literally how that fear gets priced. It's not about ideology—it’s about how jumpy the Treasury market expects yields to be, and whether traders are willing to hold exposure during such times. Look at what happened:

And swap spreads blew out. That wasn’t ideology. That was fear. Of the unknown. And a sign that the leveraged players were fed up.

I spent years talking to the biggest bond traders in the world. Not one of them ever worried over one bad budget deficit. They care about two things: carry and volatility. One makes them rich, Hamptons-style. The other makes them unemployed.

The Fed knows they need the hedgies. This April, it stood by. Ready. Loaded. Unused.

But the Fed can’t calm a market that’s scared of Washington, not Wall Street.

Markets Aren’t Moral. They’re Just Leveraged.

Here’s the thing about myths: They survive because they’re useful.

Bond vigilantes are perfect villains. Invisible. Powerful. Selectively angry.

The myth won’t die. Bond vigilantes make for great copy. They’re shadowy. They’re a clean narrative.

Politicians love them because they explain failure without responsibility.

We can’t spend on that. The bond vigilantes will come for us.

Wall Street loves them because it feels like a compliment. And it feeds the “small government” narrative.

But let’s get real. The US isn’t Sri Lanka. It’s not even the UK. It’s not going to get punished for spending money in its own currency. Not when the alternatives are, you know, the Euro. Or the Yen.

Most Treasury holders are prisoners of structure. Mandated. Benchmarked. Handcuffed to the yield curve. Or they hold because they have no other place to keep their reserves.

The traders who can move markets? They’re leveraged, twitchy, and short-term. And they don’t care about fiscal probity. They care about P&L.

And they’re not punishing fiscal excess. They’re punishing risk. The kind of risk that ruins their quarterly letter and makes LPs angry.

This isn’t about spending too much. And it’s definitely not about spending too little.

It’s about a Fed addicted to stability feeding an investor class addicted to carry.

So maybe bond vigilantes aren’t heroes. Maybe they aren’t villains.

Maybe, like all good bedtime stories, they were never real to begin with.

This matters. I’ll explain more in a future blog.